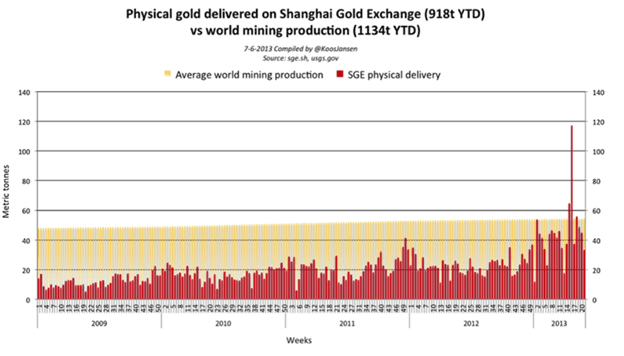

While the propaganda artists in America try to get you to keep your money in the bank where they can take part of it from time to time âfor your own good,â Chinese people are not so trusting of their governments. The chart below should be seen as a barometer for trouble brewing in the international markets. Look at the enormous amount of gold that is being purchased in China compared to the amount of gold that is being produced from the mines. The amount of physical gold being taken off the markets, especially as the yellow metal declines, is a statement of âno confidenceâ in the existing established monetary order. The Chinese know, as most humans do who have not been deprogrammed to think otherwise, that gold is the eternal store of value and that politicians use fiat money as a means of theft. The Chinese know that. Americans are about to learn that very soon!

Meanwhile, the Indian government, for fear it will lose control of its ability to use fiat money to rob its populace, is apparently trying to shut down gold buying in India: âIndiaâs Reliance Capital Suspends Gold Salesâ http://t.co/RF278yEzVY.

Pinocchioâs nose is getting longer and longer. The day is coming when people around the world will recognize the big lie and honest money. For now, what we all need to do is vote with our feet and to the extent possible opt out of the system by putting cash under the mattress or in some safe place, and of course with the cash you donât need for transactional purposes, exchange it for real money, namely, gold and silver, which cannot be printed out of existence as Mr. Bernanke is now doing with the dollar.

So what is the downside for gold and gold shares? Charles Nennerâs downside target has been met but he is not quite yet ready to go long on gold. It could be that we meander around these levels for a bit longer. But whether you are talking about gold or gold shares, a look at the gold share chart above suggests to me the downside is very, very minimal. At the same time, the upside potential for the shares and bullion, given all the problems in the global economy is absolutely enormous. The risk/reward for gold and gold shares, compared to stock, has not been this favorable for quite a few years.

Jay Taylor

www.jaytaylormedia.com

www.miningstocks.com

Jay Taylor Host of Turning Hard Times Into Good Times Jay Taylor is the host of Turning Hard Times Into Good Times on the VoiceAmerica Business Channel. The insights provided to Jay came from a history professor in 1967 who advised Jay that when countries go off a gold or silver standard, hard economic times are sure to follow because nations begin to think they do not need to work hard and save to enjoy a better life. Indeed there is no free lunch and a gold standard reminds people of that every day. Jay watched his professorâs prophetic words come true when in 1971, President Nixon completely detached the dollar from gold. Not surprising to Jay, the price of gold skyrocketed in the late 1970s as inflation wiped out vast amounts of wealth from average Americans. To protect his own wealth Jay began to invest in gold and gold mining shares and in 1981 he began sharing his success and insights in his newsletter. In 1981 Jay began writing a subscription newsletter that has earned his subscribers countless thousands of dollars over the years. Jayâs insights as to the real cause of our problems has enabled him to find investment strategies that work. Diagnose a problem correctly and you have a chance for success.