Dear John,

Was there actually a regional banking issue? I say this in jest, as I am honestly afraid to write this for the omen it might invite. But in all seriousness, people paused for a day or two and then simply moved on. That said, we are not out of the woods yet; we’ve all heard about a few anecdotal hiccups, but they have been limited. Pricing is the name of the game; we are seeing bidding wars for some properties and not even showings on others…so it’s a bit chaotic for some to grasp. It’s like watching a time-lapse clip of a busy NYC intersection, seemingly chaotic and random, but in actuality, like the intersection, the market is quite orderly….with a few aberrations of course, heck it’s Manhattan!

The year started off far more tentatively than pre-covid years; it was a lingering hangover from the second half of last year’s languid performance. After those notions have since thawed. The “need” for housing and sensible seller price reductions have accelerated deal volume over the past 60 days. The market is in a very good place…it is not frenzied; you actually have some time to think (a luxury in Manhattan real estate). Interestingly, the super-luxury segment of the market seems to be the slowest; but it too has been gaining momentum for many weeks now.

Successful sellers have been those who acknowledged “the moment” of weaker demand and higher interest rates and priced (or reduced price) to meet those lower bid levels. The sellers who haven’t made those adjustments remain on the market with eroding values. The “new” inventory that is just hitting the market, if priced appropriately, will get a lot of attention. As sentiment improves and (again) “need” becomes increasingly intense, those buyers starved for that new inventory will flock, while the old stuff sits. That said, opportunity exists in those old listings. Buyers should probe for those listings which have been on the market for a long time, in search of a deal or an opportunity to substantially negotiate. Likewise, for those properties requiring work. With supply chain and renovation delays easing substantially, those apartments possess a potential to capture tremendous value.

Market Pulse

“Showing Market Pulse for any bedroom configuration in All Manhattan for all prices. Courtesy UrbanDigs

Deal volume has been methodically increasing. The most robust activity has occurred in the lower price ranges and wanes as you go up the price scale. This is ironic, as the lower price ranges are typically the most interest-rate-sensitive segments of the market, whereas higher price points, with a far higher percentage of all-cash deals, are “typically” far less affected. What it tells us is that the core base of New Yorker’s are in buying mode, regardless of rates. They realize that identifying the right property now is most important; they can refinance later when rates ease. It also follows right along with what I always say, “The greatest barrier to purchasing in Manhattan is not the price, but the competition” (is it ridiculous that I am quoting myself?…embarrassing really). It’s like a dance floor, there are currently people dancing and many people simultaneously circling, looking for their partner; it’s active…there are choices of people to dance with. This is a big contrast from the second half of last year when no one was even at the dance.

Today’s active buyers have also acknowledged “the moment” of higher (but not unreasonable) interest rates and feel a fairness in the marketplace; they are trying to seize it. Mortgage brokers are also reporting increased loan application activity; this is evidence of both deal volume and those in preparation to buy.

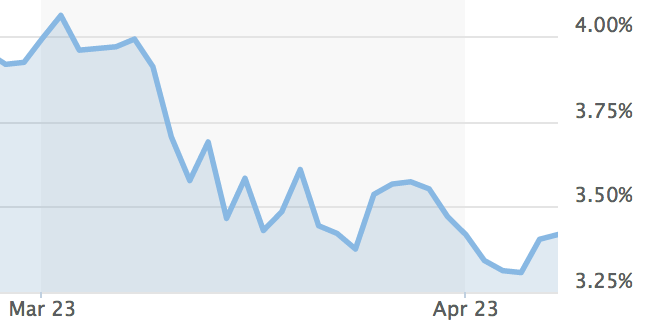

U.S. 10 Year Treasury Note

What the future holds is impossible to predict, but we are optimistic. The credit markets, which are generally pretty savvy, are betting on better times. With inflation coming down they feel rates have stopped rising, except for possibly one more ¼ point increase at the next Fed meeting. Even better, the terminal rate has many seeing an actual drop in rates by year’s end. As you can see above, we have already seen the 10 year treasury note drop quite a bit in the past couple weeks, which is also helping to fortify many of these regional banks with a bit more liquidity. This along with strong employment numbers has an increasing number of economist thinking we could possibly avoid a meaningful recession.

As you know, I always say two things: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.