When Adam Smith prescribed a modern economic framework to free the world of the oppression of Colonial Economy, he saw Capitalism as a process of wealth building for individual nations. He saw Labor as the true wealth creator and Capital as the seed money that was necessary in the process of converting raw material into finished products to drive the economic engine. Regulation was seen as the referee to insure neither those investing the capital nor the ones expending labor had the upper hand, so as to maintain the required equilibrium for building the “Wealth of Nations”. Responsible capitalism understands the need for equilibrium. It uses regulations sensibly, to effectively utilize labor and capital in the pursuit of wealth creation.

Educating members of society on how the economy works and how one could actively engage in the economy to shape their own economic wellbeing should not be optional. Societies that value its citizenry view such an education as basic investment. Home, school, and self-learning all have a role in laying the foundation for such an impactful knowledge pursuit. This is the kind of knowledge that prepares a society for life, innovation and self-determination.

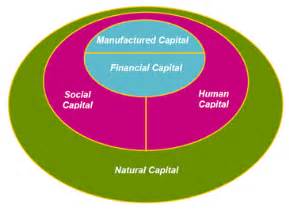

One does not need to start with financial capital to attain financial freedom. I say this based on my personal experience. I came to the US in 1995, as a working adult professional to earn my MBA. I had accumulated 3-months of paid time off and withdrew my Provident Fund (Retirement Fund) to start a new chapter. My employer, Standard Charted Bank, gave me the option, in writing, to come back if things did not work out or once I finished my MBA. That was my social capital at work by an employer who valued its human capital. When I converted my Sri Lankan Rupees to US Dollars, at the rate of more than 100:1, I knew how far my financial capital could go. Not far enough for a full semester and not far enough in most American communities where education was 1/3 the cost while cost of living was 2/3. I researched and found a University with the highest MBA accreditation but with one of the lowest cost of living in the US.

I chose Indiana State University at Terre Haute, Indiana, and started my graduate program in the shorter Summer Semester. I put my financial asset to its optimal use. Then I demonstrated the value of my human capital to the Department of Continuing Education and negotiated a Graduate Assistantship in automating and managing the university Summer Session and Annual Continuing Education Program Budgets. That paid for my MBA and gave me a cost of living allowance. When I graduated, AT&A hired me and moved me to the Chicago Market. I relocated to Chicago in the car of my best friend, taking with me all my worldly possessions. My books, a $9 used mattress I had purchased from a Chinese student and 2 plastic chairs I purchased from Dollar General for $10. My real wealth was my knowledge, my social capital comprising of my lasting relationships and my deep appreciation for the collective human capital. In the 20-years I have lived and worked in Chicago, I have been able to seek my own economic empowerment but it was not accomplished alone. Countless relationships have helped me get here and I have kept the Triple Bottom Line and shared prosperity in perspective in building win-win partnerships.

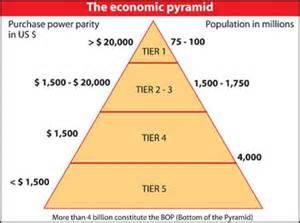

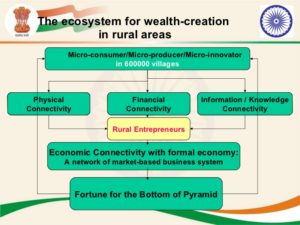

| Today, I educate others as a professor, consult for business as a practitioner, and volunteer through organizations as a responsible citizen to share my experience to help others seek their own economic freedom. Our modern global economy is market driven. That market has 75 – 100 Million of the world’s population at the top of the Economic Pyramid making over US $20,000 in a year; Over 4 Billion people are at the bottom of the pyramid making US $1,500 or less. This tells us that the businesses that have a sustained economic value creation capability, over the long haul, are those that serve the 4 Billion at the bottom of the pyramid through responsible capitalism to give these people dignity and choice by delivering high quality, low cost goods and services in small quantities accessible through local markets. This is a strategy formulated by Dr. C. K. Prahalad, taught in Business Schools and put into practice by global corporations like Unilever. |

|

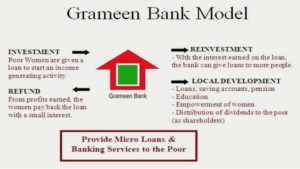

Institutions like Grameen Bank, started by MBA students in Bangladesh, have given the world access to Micro Credit. Practices such as these are enabling economic empowerment and social entrepreneurs across developing nations in Asia and Africa to make financial freedom possible to countless communities. This model for developing nations can find application in various under developed communities of developed nations. This model can be utilized by any community, to transform their economic status, through collaborative partnerships with businesses, local governments, non-profit organizations and motivated social entrepreneurs.

Financial freedom through economic empowerment is possible, with the shared transformational journey in one community at a time. For communities to seek this economic empowerment successfully, the women and men in the communities should be equally empowered. This week, I will engage Jonathan Gripe, Financial Advisor from Edward Jones, in a conversation of how individuals and families can build their way to financial freedom. Financial freedom has to start with being open to learn, grow, pay ourselves before paying others and re-thinking the definition of capital and market in our modern global economy. Individual and community transformation is needed for this journey, with an approach of all hands on deck. The good news is, together we can do it! Please join me in exploring how we can take the necessary steps towards this financial freedom!